The Companies Act, 2013 (the Act) acts as the backbone of corporate governance in India, outlining regulations that ensure transparency, accountability, and fairness in company operations. Among these, Section 185 holds significant weight as it addresses the sensitive topic of loans and guarantees to directors and related parties.

This blog post caters specifically to CA (Chartered Accountant) Inter and Final aspirants, aiming to demystify Section 185 and its implications. We’ll delve into the intricacies of the section, explore its exceptions, and address commonly encountered questions.

Table of Contents

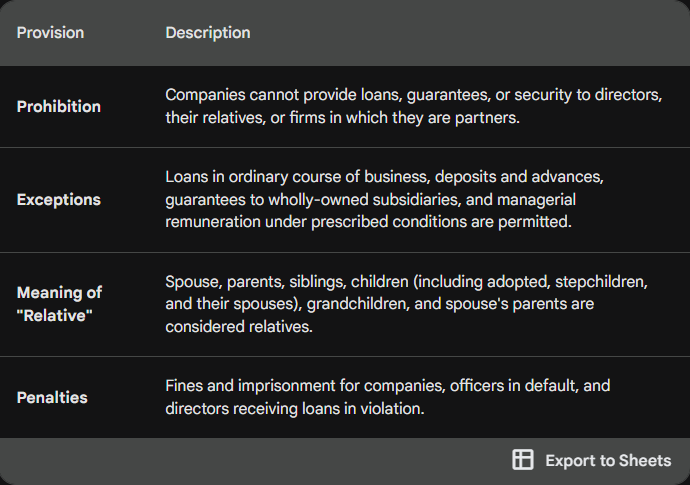

Understanding the Core Prohibition

Section 185(1) states that a company shall not, directly or indirectly, provide the following to its directors, their relatives, or firms in which they are partners:

- Loans (including credit card advances)

- Guarantees in respect of loans taken by them

- Security in connection with such loans

This prohibition exists to ensure that directors’ personal interests don’t conflict with their fiduciary duties towards the company and its shareholders. Granting undue financial benefits to directors could potentially lead to misuse of company funds and unfair advantage to specific individuals.

Exceptions to the Rule: When Can Companies Grant Loans?

While Section 185 establishes a general prohibition, the Act recognizes certain permissible exceptions under specific circumstances. These exceptions are crucial for understanding the practical application of the section and are outlined in Section 185(2):

- Ordinary Course of Business: Companies engaged in the business of providing loans or guarantees can continue doing so in the ordinary course of business. However, the loan must be:

- Sanctioned by the Board in accordance with the company’s loan policy.

- Offered at an interest rate not less than the bank rate declared by the Reserve Bank of India (RBI).

- Deposits and Advances: Companies can accept deposits or advances from directors, subject to specific conditions and regulations laid down by the Act and other applicable laws.

- Subsidiary Companies: A holding company can provide a guarantee in respect of a loan taken by its wholly-owned subsidiary company from a bank or financial institution. However, the loan must be utilized for the subsidiary’s principal business activities.

- Managerial Remuneration: Companies can provide loans or advances to their directors as part of their remuneration package, adhering to prescribed limits and specific conditions mentioned in the Act and relevant rules.

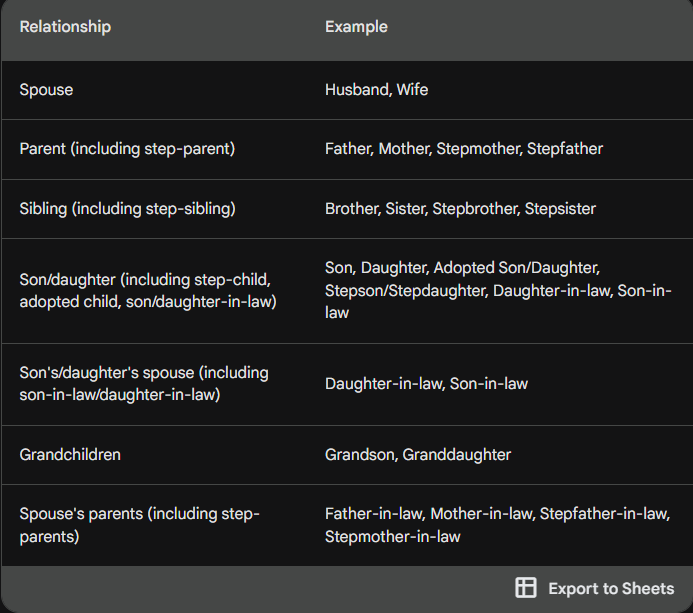

Meaning of “Relative” Under Section 185:

The Act defines “relative” to include a specific set of individuals. Understanding who falls under this definition is crucial for applying Section 185 effectively. Here’s a detailed breakdown:

Who are considered relatives?

Who are NOT considered relatives?

- Uncle/Aunt (including step-uncle/aunt)

- Cousin (including step-cousin)

- Niece/Nephew

- In-laws (other than spouse’s parents)

Detailed Example: Loan for Medical Emergency

Let’s consider a scenario to illustrate the applicability of Section 185 and its exceptions:

- ABC Ltd., a company not engaged in the business of providing loans, faces a situation where its Managing Director (MD), Mr. Sharma, requires an urgent loan for a critical medical emergency.

In this case:

- Direct Loan: As per Section 185(1), ABC Ltd. cannot directly grant a loan to Mr. Sharma. This prohibition safeguards the company’s funds and prevents potential misuse.

- Alternative Options:

- Personal Loan: Mr. Sharma can explore obtaining a personal loan from a bank or financial institution based on his creditworthiness.

- Leave Encashment: ABC Ltd. can consider allowing Mr. Sharma to encash his earned leave as per company policy and applicable labor laws. This approach would be a legitimate way to provide him with some financial assistance without violating Section 185.

Penalties for Non-Compliance

Violation of Section 185 attracts penalties for the following parties:

- Company: Fine up to ₹50 lakh.

- Officer in default: Imprisonment up to 1 year or fine up to ₹5 lakh, or both.

- Director who received the loan: Imprisonment up to 6 months or fine between ₹5 lakh and ₹25 lakh, or both.

Frequently Asked Questions (FAQs)

- What is considered a “relative” under Section 185?

The Act defines “relative” to include:

- Spouse

- Parent (including step-parent)

- Sibling (including step-sibling)

- Son/daughter (including step-child, adopted child, son/daughter-in-law)

- Son’s/daughter’s spouse (including son-in-law/daughter-in-law)

- Grandchildren

- Spouse’s parents (including step-parents)

- Can a company provide a loan to a director’s company (not a firm)?

No, Section 185 also applies to companies in which the director has a direct or indirect interest. Therefore, providing a loan to a director’s company would be considered a violation.

- What happens if a company accidentally grants a loan to a director in violation of Section 185?

If the company identifies the violation promptly, it can take corrective measures like recovering the loan or converting it into share capital. However, seeking legal advice is crucial in such situations.

- Can a listed company provide loans to its directors for subscribing to its shares?

Yes, listed companies can offer loans to their directors for subscribing to its shares under specific regulations outlined in the Securities and Exchange Board of India (SEBI) Listing Obligations and Disclosure Requirements) Regulations, 2015.

- What are the different types of security prohibited under Section 185?

The section prohibits providing any form of security, including:

- Mortgages

- Pledges

- Hypothecation

- Guarantees

Conclusion

Understanding Section 185 is crucial for CA aspirants and professionals involved in corporate governance. By grasping the core principles, exceptions, and implications, you can ensure informed decision-making and compliance with the Companies Act. Remember, this blog post serves as a basic overview, and seeking professional guidance for specific situations is always recommended.

Remember: It’s important to consult with a qualified professional for any legal or financial advice specific to your situation.

Do checkout our other articles on taxation by clicking here.

Checkout the bare act on MCA website here