For CA students, navigating the intricacies of company law can be a daunting task. But fret not, future chartered accountants! Today, we delve into Section 186 of Companies Act 2013, a crucial provision governing a company’s lending and investment activities.

Table of Contents

Understanding the Essence of Section 186 of Companies Act 2013

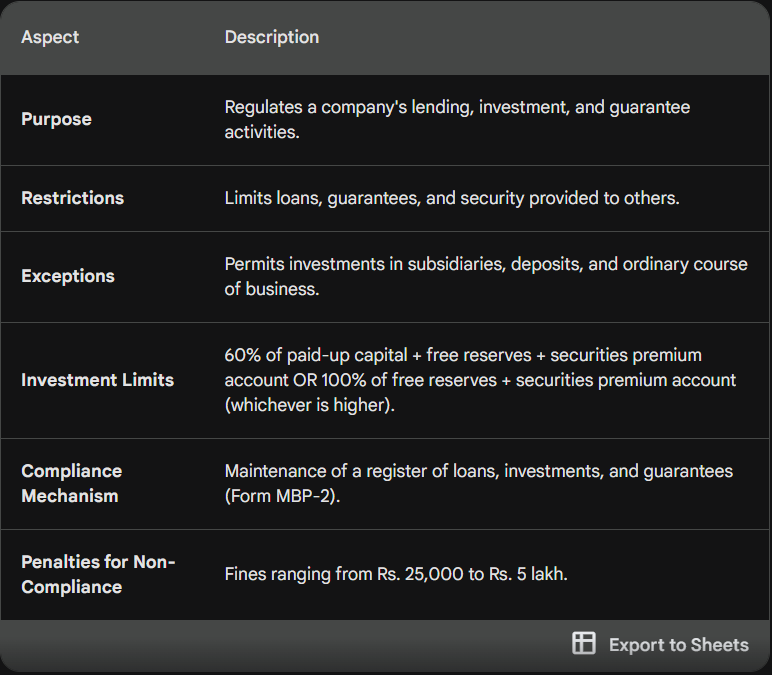

In essence, Section 186 of companies act 2013 acts as a safeguard, ensuring that companies manage their finances prudently. It dictates the limitations a company faces when it comes to providing loans, guarantees, and making investments in other entities.

Key Restrictions Imposed by Section 186 of Companies Act 2013

- Curbs on Loans and Guarantees: A company cannot directly or indirectly:

- Grant loans to any individual or other corporate body (Section 186(2)(a))

- Provide security or act as a guarantor for loans availed by others (Section 186(2)(b))

- Limitations on Investments: The Act restricts a company from:

- Acquiring securities (shares, debentures, etc.) of another company through purchase, subscription, or any other means (Section 186(2)(c))

Exceptions to the Rule

While the above restrictions seem comprehensive, there are certain exceptions:

- Subsidiary Companies: A company can invest in its own subsidiary companies.

- Deposits from Public: A company can accept deposits from the public subject to specific regulations under the Companies Act.

- Ordinary Course of Business: A company can make investments as part of its normal business operations, such as purchasing raw materials or equipment.

Investment Limits: Striking a Balance

Section 186 also imposes limitations on the total quantum of investments a company can undertake. The Act stipulates that the aggregate amount of loans, guarantees, and investments cannot exceed the following thresholds:

- 60% of the paid-up share capital + free reserves + securities premium account (whichever is greater)

OR

- 100% of the free reserves + securities premium account (if free reserves and securities premium account surpass the paid-up capital)

Maintaining a Register: Transparency is Key

To ensure transparency, companies making loans, investments, or providing guarantees are mandated to maintain a register in Form MBP-2. This register contains details of such transactions for scrutiny by stakeholders.

Detailed Example: Understanding the Application of Section 186 of companies act 2013

Let’s illustrate the application of Section 186 of companies act 2013 with a practical scenario:

- ABC Ltd. has a paid-up share capital of Rs. 100 crore, free reserves of Rs. 50 crore, and a securities premium account of Rs. 20 crore.

Scenario 1: Permissible Investment

ABC Ltd. intends to invest Rs. 40 crore in a new project. As the investment (Rs. 40 crore) is well within the limit of 60% of its combined reserves (Rs. 170 crore), this investment complies with Section 186.

Scenario 2: Non-Compliance

If ABC Ltd. decides to invest Rs. 90 crore in the project, it would exceed the permissible limit. This scenario would trigger a violation of Section 186.

- XYZ Ltd. has a paid-up capital of Rs. 20 crore, free reserves of Rs. 12 crore, and a securities premium account of Rs. 8 crore. XYZ Ltd. plans to invest Rs. 15 crore in a new venture.

Calculation: Permissible investment limit = 60% of (20 crore + 12 crore + 8 crore) = Rs. 24 crore.

Analysis: Since the planned investment (Rs. 15 crore) is within the limit (Rs. 24 crore), XYZ Ltd. complies with Section 186.

- PQR Ltd. has a paid-up capital of Rs. 50 crore, free reserves of Rs. 30 crore, and a securities premium account of Rs. 10 crore. PQR Ltd. intends to invest Rs. 100 crore in a subsidiary company.

Calculation: Permissible investment limit = 60% of (50 crore + 30 crore + 10 crore) = Rs. 54 crore.

Analysis: The planned investment (Rs. 100 crore) exceeds the limit (Rs. 54 crore), violating Section 186.

Case Studies:

- Satyam Computer Services Scandal: This infamous case involved inflated profits and fraudulent financial reporting. The company’s excessive investments in unrelated ventures, potentially in contravention of Section 186 principles, contributed to its downfall.

- Tata Motors’ Investment in Jaguar Land Rover: This successful acquisition demonstrates a strategic investment within the company’s core business activities, aligning with the spirit of Section 186.

Penalties for Non-Compliance

Companies or officials contravening Section 186 of companies act 2013 provisions can be penalized with a fine ranging from Rs. 25,000 to Rs. 5 lakh.

Key Takeaways for CA Aspirants

- Grasp the limitations imposed by Section 186 of companies act 2013 on a company’s lending and investment activities.

- Understand the exceptions that permit certain investments.

- Be familiar with the calculation of investment limits based on the company’s financial position.

- Recognize the importance of maintaining a register of loans, investments, and guarantees.

FAQs for Aspiring Chartered Accountants

Q: Can a company provide loans to its directors?

A: Generally, no. Section 186 of companies act 2013 restricts loans to directors unless permitted under specific circumstances, such as for subscribing to shares or meeting travel expenses.

Q: What happens if a company invests beyond the permissible limit?

A: Such an act would be considered a violation of Section 186 of companies act 2013 and could attract penalties.

Q: How does the MCA monitor compliance with Section 186?

A: The Ministry of Corporate Affairs (MCA) may conduct inspections and scrutinize company filings to ensure adherence to the provisions of this section.

practical Applications and Further Exploration

Beyond the Basics: Understanding the Rationale

Section 186 serves a critical purpose in safeguarding the financial health of companies. Here’s why:

- Prevents Reckless Investment: Unrestricted lending and investment can expose a company to risks, potentially jeopardizing its solvency and ability to meet its obligations.

- Protects Creditor Interests: By limiting excessive investments, Section 186 ensures that a company prioritizes its core operations and has sufficient resources to settle dues with creditors.

- Maintains Investor Confidence: Responsible financial management fosters trust among investors, promoting a stable and healthy business environment.

Case Studies: Learning from Real-World Examples

For a deeper understanding, let’s explore real-world scenarios where Section 186 of companies act 2013 comes into play:

- Company A invests heavily in a subsidiary that performs poorly, leading to significant financial losses. This could have been prevented by exercising prudence as mandated by Section 186.

- Company B provides excessive loans to its directors, hindering its ability to invest in core business activities. This highlights the importance of adhering to the restrictions on loans to related parties.

Further Exploration: Delving Deeper

- Analyze recent case laws pertaining to violations of Section 186 to gain insights into judicial interpretations and implications.

- Research the MCA’s guidelines on the implementation of Section 186 for a comprehensive understanding of compliance procedures.

- Explore the concept of related party transactions and how they are regulated under the Companies Act, 2013.

Conclusion

Equipping yourself with a thorough understanding of Section 186 is an invaluable asset for CA aspirants. By grasping its nuances, limitations, and practical applications, you’ll be better prepared to navigate the complexities of corporate finance and excel in your professional journey.

Remember: This blog post provides a foundational understanding of Section 186. It’s recommended to consult the Act itself and relevant reference materials for a more in-depth analysis.

Do checkout our other articles on law by clicking here!

Read bare act by clicking here!