Ever opened your mailbox to find a cryptic tax document and felt a wave of confusion wash over you? Don’t worry, you’re not alone! Navigating the world of direct and indirect taxes can feel like deciphering an ancient language, especially when it comes to understanding the difference between direct taxes and indirect taxes. But fear not, intrepid explorer! This guide is here to be your friendly compass, helping you demystify these crucial aspects of the tax system in a way that makes sense, no matter your financial background.

Imagine this: you’re enjoying a delicious pizza with friends, savoring each flavorful bite. But have you ever wondered where a portion of the money you pay goes beyond just the cost of ingredients and cooking? Well, a part of it contributes to taxes, which are essentially the contributions individuals and businesses make to the government. These contributions help fund various public services like roads, schools, hospitals, and even that cool park where you enjoy your weekend picnics.

But not all taxes are created equal! There are two main categories: direct taxes and indirect taxes. Let’s break them down in a way that’s easy to understand, using everyday examples to bring these terms to life:

Table of Contents

Direct Taxes: You Pay the Bill Directly

Think of your monthly salary. A portion of it gets deducted directly by the government as income tax. This means you, the taxpayer, directly pay this tax to the government. It’s like paying a bill directly to the store for the groceries you pick up.

Here’s another example: if you run a small business selling handcrafted jewelry, you’ll likely need to pay corporation tax on your company’s profits. This tax is similar to income tax, but it applies to businesses instead of individuals.

Indirect Taxes: Embedded in the Price You Pay

Now, back to the pizza. Remember the deliciousness you just experienced? Well, the price you paid likely included a Goods and Services Tax (GST), which is an example of an indirect tax. In this scenario, you, the consumer, indirectly pay the tax because it’s already incorporated into the final price of the product or service. It’s like a hidden cost, pre-added to the pizza by the restaurant before it even reaches your table.

Some other common indirect taxes include:

- Customs duty: If you ever order a unique tea set online from abroad, you might encounter customs duty, which is a tax levied on imported goods.

- Excise duty: This tax is typically levied on specific goods produced within the country, like cigarettes or alcoholic beverages. Think of it as a special tax added to certain items during their production stage.

The Key Difference in direct and indirect tax: Who Bears the Burden?

The key difference between direct and indirect taxes lies in who ultimately bears the burden of the tax.

- Direct taxes: You directly pay the government, like paying a bill for your monthly utilities.

- Indirect taxes: You pay the government indirectly through the price you pay for goods and services, like the hidden tax included in your pizza price.

A Real-Life Example:

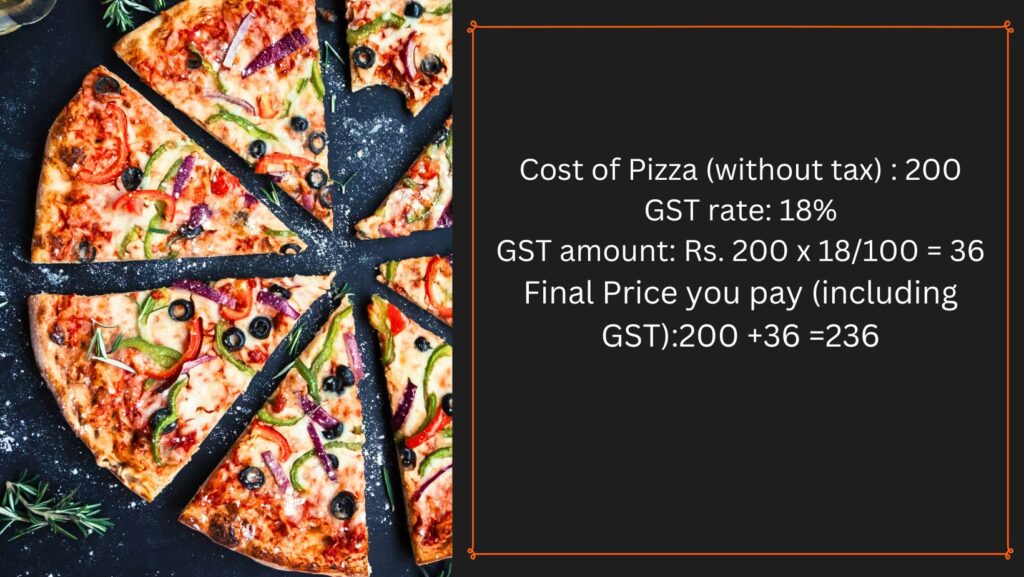

Let’s revisit the pizza example with some numbers:

- Cost of pizza (without tax): ₹200

- GST rate: 18%

- GST amount: ₹200 x 18/100 = ₹36

- Final price you pay (including GST): ₹200 + ₹36 = ₹236

In this scenario, while you pay ₹236, the burden of the ₹36 GST ultimately falls on you as the consumer. The restaurant collects this tax and then remits it to the government.

Why Do We Have Different direct and indirect Taxes?

The government needs to raise money, and both direct and indirect taxes are essential to this process. However, they have distinct impacts:

- Direct taxes: These are generally considered fairer as the tax burden increases with income or wealth. Imagine two friends, one earning a high salary and the other earning a modest income. The friend with the higher income will pay more income tax, reflecting their ability to contribute more.

- Indirect taxes: These can be challenging for low-income individuals who spend a larger portion of their income on essential goods and services that are subject to these taxes. Imagine buying groceries and everyday essentials – regardless of your income level, the indirect taxes (like GST) are already embedded in the price, and these costs can add up significantly for those with limited financial resources.

Choosing Your Path: Opportunities for CA Aspirants

Understanding both direct and indirect taxes is crucial for aspiring Chartered Accountants (CAs) who wish to specialize in tax law and practice. They can

specialize in various areas like:

- Direct Tax: Advising individuals and businesses on income tax planning, return filing, and representing them before tax authorities. Imagine yourself as a financial wizard, guiding clients through the complexities of income tax calculations and ensuring they comply with regulations.

- Indirect Tax: Helping businesses comply with GST, customs duty, and excise duty regulations. You could become an expert in the ever-evolving world of GST, advising companies on how to navigate this complex tax system and ensure smooth operations.

The choice ultimately depends on individual interests, career goals, and job market preferences. Some might find the analytical nature of direct tax appealing, while others might enjoy the dynamic environment of indirect tax, constantly evolving with new regulations and trends.

Knowledge is Power: Benefits for Everyone

Regardless of your professional aspirations, understanding both types of taxes empowers everyone to:

- Make informed financial decisions: Knowing the impact of different taxes helps you plan your finances effectively and potentially reduce your tax liability. Imagine being able to optimize your tax contributions, maximizing your savings and making smarter financial choices for the future.

- Claim tax benefits: The government offers various deductions and exemptions that can help you lower your tax burden. By understanding these benefits, you can utilize them to their full potential and reduce your tax liability. Think of it as finding hidden discounts and maximizing your savings!

- Fulfill your tax obligations: By understanding different tax types and filing requirements, you can ensure timely and accurate tax compliance. This contributes to a healthy financial system and avoids any potential penalties or legal issues.

Remember: This information empowers you to approach tax season with a bit more confidence, knowing the difference between the two main types of taxes and how they impact you. So, the next time you hear the word “tax,” don’t let it send shivers down your spine! Instead, think of it as contributing your part to building a better society. With this newfound knowledge, you can navigate the tax world with a little more ease and maybe even transform it from a confusing maze to a path of informed financial decisions.

Do you have any questions about direct and indirect taxes? Ask below!

P.S. Do read our previous article on various taxation topics by clicking here.