Introduction:

Delving into the realm of taxes can often feel like navigating through a maze of complex terms and regulations. Among these, understanding the tax abatement meaning holds significant importance for individuals and businesses alike. In this detailed guide, we unravel the layers surrounding tax abatement meaning, shedding light on its definition, applications, examples, regulations, common misconceptions, and FAQs. By the end, you’ll emerge with a comprehensive understanding of this crucial aspect of taxation.

Table of Contents

Key Takeaways

- Tax abatement is a powerful tool: Governments utilize tax abatement to incentivize specific behaviors or investments, ultimately contributing to economic development and community growth.

- Understanding is crucial: It’s essential to comprehend the meaning, implications, and regulations surrounding tax abatement for effective utilization.

- Opportunities for individuals and businesses: By grasping tax abatement concepts, individuals and businesses can strategically leverage opportunities to optimize their tax strategies and contribute to economic growth and development.

Tax Abatement Meaning: Exploring its essence.

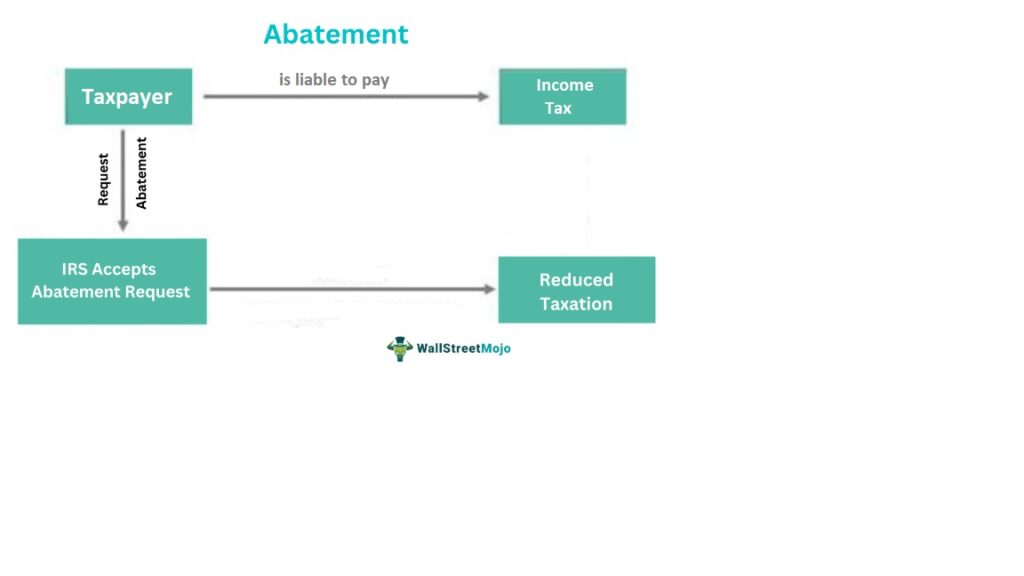

Understanding tax abatement meaning is fundamental to navigating the intricacies of taxation. Essentially, tax abatement refers to a reduction or exemption granted by a government authority on taxes owed. This reduction aims to incentivize certain behaviors or activities deemed beneficial for the community or economy. Whether it’s stimulating economic development, encouraging investment in specific areas, or promoting sustainability initiatives, tax abatement serves as a strategic tool in the hands of policymakers.

The Significance of Tax Abatement in Economic Development

Tax abatement plays a pivotal role in fostering economic growth and development within communities. By offering incentives such as reduced property taxes or exemptions on business investments, local governments attract businesses and spur job creation. This, in turn, contributes to a thriving economy, improved infrastructure, and enhanced quality of life for residents.

Examples of Tax Abatement in Practice

To grasp the tax abatement meaning, let’s consider a few illustrative examples:

- Property Tax Abatement: A city offers a five-year property tax abatement to homeowners who invest in energy-efficient upgrades for their residences.

- Business Investment Incentives: A state government grants a tax abatement to a company setting up a manufacturing plant in an economically disadvantaged area, aiming to stimulate job creation and revitalization.

- Historic Preservation Tax Credits: A federal program provides tax abatements to property owners who undertake the restoration of historic buildings, preserving cultural heritage while revitalizing neighborhoods.

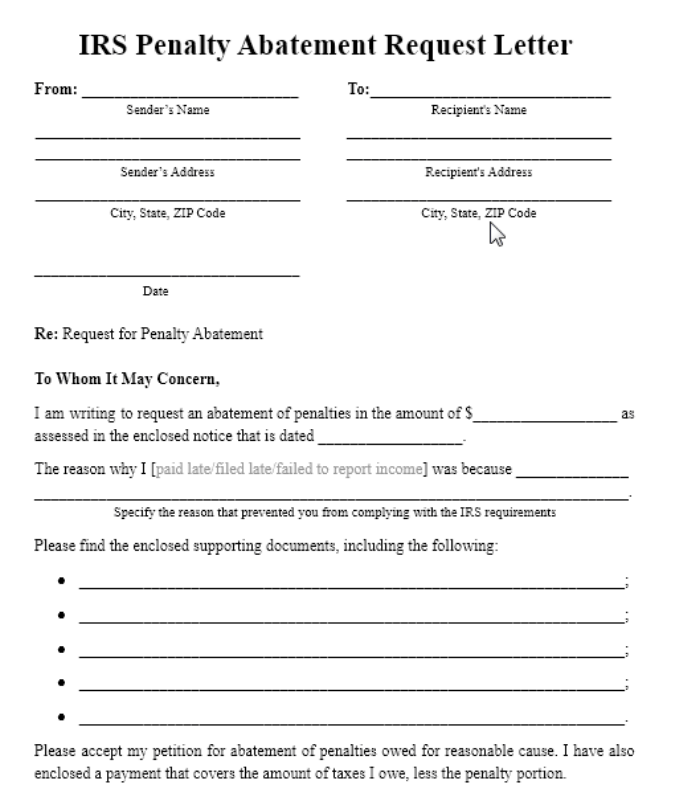

- A sample of a request letter for IRS Penalty: Please find below a sample of a tax abatement request letter.

Navigating Tax Abatement Regulations

While tax abatements offer valuable incentives, navigating the associated regulations is crucial to ensure compliance and maximize benefits. Understanding the eligibility criteria, application procedures, and reporting requirements is essential for individuals and businesses seeking to leverage tax abatement opportunities. Consulting with tax professionals or legal advisors can provide invaluable guidance in this process.

Tax Abatement meaning: Addressing Common Misconceptions

Despite its benefits, tax abatement is often subject to misconceptions and misinterpretations. One common misconception of tax abatement meaning is a complete exemption from taxes, whereas, in reality, it usually involves partial reductions or exemptions for a specified period. Clarifying such misconceptions is essential to facilitate informed decision-making regarding tax planning and compliance.

Exploring Tax Abatement Implications

Beyond its immediate benefits, tax abatement can have broader implications for communities and the economy. For instance, by incentivizing investments in renewable energy or affordable housing, tax abatement can contribute to sustainability goals and address social equity concerns. Moreover, tax abatement programs can influence business location decisions, attracting industries that align with the community’s priorities and growth objectives.

The Role of Tax Abatement in Real Estate Development

In the realm of real estate development, tax abatement often plays a significant role in shaping investment decisions and project viability. Developers may seek tax abatements as part of financing arrangements to offset development costs or enhance project returns. Additionally, municipalities may use tax abatement as a tool to encourage redevelopment in blighted or underutilized areas, driving urban revitalization efforts.

Frequently Asked Questions (FAQs)

Q: What is the primary objective of tax abatement?

A: The primary objective of tax abatement is to incentivize certain behaviors or investments deemed beneficial for the community or economy by granting reductions or exemptions on taxes owed.

Q: How does tax abatement contribute to economic development?

A: Tax abatement stimulates economic development by attracting businesses, encouraging investments, and fostering job creation within communities.

Q: Are tax abatements permanent?

A: Tax abatements are typically granted for a specified period, after which they may expire or require renewal based on the terms and conditions established by governing authorities.

Q: Can individuals qualify for tax abatements?

A: Yes, individuals may qualify for tax abatements based on specific criteria established by governing authorities, such as investments in energy-efficient upgrades or historic property preservation.

Q: How can businesses leverage tax abatements for strategic advantage?

A: Businesses can leverage tax abatements to reduce operating costs, enhance competitiveness, and facilitate expansion or relocation initiatives, particularly in designated economic development zones.

Q: What steps should individuals or businesses take to explore tax abatement opportunities?

A: To explore tax abatement opportunities, individuals or businesses should research eligibility criteria, consult with tax professionals or legal advisors, and adhere to the application and reporting procedures outlined by governing authorities.

Conclusion:

In conclusion, grasping the nuances of tax abatement meaning is essential for individuals and businesses navigating the landscape of taxation. From understanding its fundamental definition to exploring practical examples, regulations, implications, and addressing common misconceptions, this guide has provided a comprehensive overview of tax abatement. By leveraging this knowledge and exploring potential opportunities, stakeholders can make informed decisions to optimize their tax strategies and contribute to economic growth and development.

Do check Out our Previous Article on Multi Step Income Statements by clicking here.

Pingback: Full Form of CA: It Just Takes 4.5 Years to become One!

Pingback: 5 Steps to Demystify GST Applicability for Your Business!