Imagine a giant vat of molten chocolate bubbling away, destined to become delectable bars. Tracking the cost of each individual bar amidst the gooey flow might seem impossible, right? Enter process costing, a hero in the world of cost accounting, specifically designed for such scenarios.

So, CA aspirants, buckle up! This blog post delves into the intricate world of process costing, equipping you with the knowledge to conquer your exams and impress potential employers.

Table of Contents

What is Process Costing?

Unlike its cousin, job costing, which tracks costs for individual projects, process costing focuses on continuous production processes. Think chemicals, oil refineries, or even that chocolate factory! Here, identical units flow through various stages, making it impractical to track costs for each one.

Process costing steps in, accumulating costs incurred at each stage (think ingredients, labor, and overheads) and then averaging them across all units produced. This gives you the cost per unit, a crucial piece of information for pricing, inventory valuation, and performance analysis.

When to Use Process Costing: Key Identifiers

Not every manufacturing process needs process costing. Here are the telltale signs:

- Identical units: Each unit within a batch should be indistinguishable from its peers. Think bottles of water, not custom furniture.

- Continuous production: The process flows smoothly, without discrete batches or stoppages. Imagine an assembly line, not a tailor shop.

- Significant indirect costs: Overheads like rent, utilities, and depreciation play a major role in the total cost.

Unveiling the Process Costing Flow: A Step-by-Step Guide

Let’s delve deeper with a detailed example:

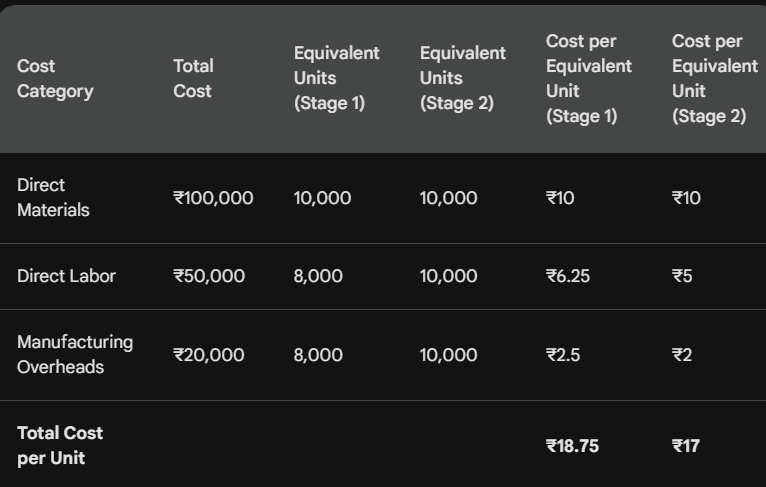

Scenario: A chemical plant produces 10,000 liters of paint in a month. Here’s how we’d use process costing:

- Identify Costs:

- Direct materials (e.g., pigments, solvents) – ₹100,000

- Direct labor (e.g., mixing operators) – ₹50,000

- Manufacturing overheads (e.g., rent, depreciation) – ₹20,000 per month

- Equivalent Units:

- Sometimes, units might be in different stages of completion at the end of the period. We need to convert them into equivalent units representing the amount of work completed on each unit.

- Cost per Equivalent Unit:

- Divide the total cost for each cost category by the equivalent units for that stage.

- Cost per Unit:

- Add the cost per equivalent unit for each stage to get the final cost per unit.

Calculations:

Key Takeaways:

- Process costing is crucial for industries with continuous production of identical units.

- It accumulates costs incurred at each stage and averages them across all units produced.

- Equivalent units help account for units in different stages of completion.

- The final cost per unit is essential for pricing, inventory valuation, and performance analysis.

Advanced Concepts for the Ambitious

For those seeking mastery, explore these advanced concepts:

- FIFO vs. Weighted Average: Different methods exist to assign costs to units within each stage.

- Normal Loss vs. Abnormal Loss: Understanding expected and unexpected material waste is crucial.

- Joint and By-products: Process costing adapts to situations where multiple products emerge from a single process.

Diving Deeper: Normal vs. Abnormal Losses in Process Costing

While process costing shines in its efficiency, losses are inevitable. But not all losses are created equal! Understanding normal vs. abnormal losses is crucial for accurate cost analysis and effective decision-making.

Normal Loss:

Imagine baking cookies. Some batter inevitably sticks to the bowl, resulting in a predictable and expected loss. This is a normal loss, inherent in the production process and factored into the cost per unit.

Abnormal Loss:

Now, picture accidentally dropping the entire batter on the floor. This is an abnormal loss, unexpected and avoidable. It shouldn’t be included in the regular cost per unit, as it might distort profitability analysis.

Illustrating the Normal and Abnormal Loss

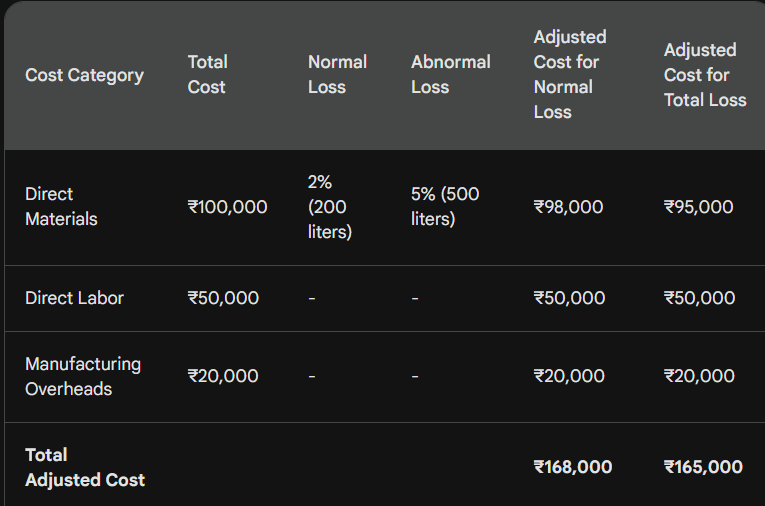

Let’s revisit our chemical plant example, incorporating normal and abnormal losses:

Scenario:

- The plant produces 10,000 liters of paint in a month.

- Normal loss: 2% of raw materials are expected to evaporate during processing.

- Abnormal loss: A faulty valve causes an additional 5% of raw materials to be lost.

Calculations:

Key Takeaways:

- Normal losses are expected and factored into the cost per unit.

- Abnormal losses are unexpected and excluded from the regular cost per unit.

- Identifying and addressing abnormal losses helps improve process efficiency and reduce costs.

Other Topics to Be Explored

For those seeking mastery, explore these advanced concepts:

- Spoilage vs. Waste: Understanding the difference between unusable and potentially salvageable materials is crucial.

- Control Charts: Monitoring losses over time using control charts helps identify and address potential issues.

- Process Improvement: Implementing corrective actions based on loss analysis can lead to significant cost savings.

FAQs for the Inquisitive Mind

Q: How do you determine the cost of abnormal losses?

A: The cost of abnormal losses is typically calculated separately and treated as an expense in the period it occurs.

Q: What are some strategies to minimize abnormal losses?

A: Regular maintenance, improved equipment, and employee training can help reduce the occurrence of abnormal losses.

Q: How does process costing handle joint and by-products?

A: Specific methods exist to allocate costs to joint and by-products based on their relative sales value or other relevant factors.

Conclusion:

Process costing, with its understanding of normal and abnormal losses, empowers you to analyze costs effectively, make informed decisions, and ultimately contribute to the success of your organization. So, CA aspirants, remember: conquer the process costing maze, and the path to cost accounting mastery will be yours!

Do Check Out our Previous Articles on Prime Cost and Standard Costing to superpower your understanding!

Credits for Featured Image goes to Canva! Thanks for providing such wonderful images.